The Basic Principles Of Pacific Prime

The Basic Principles Of Pacific Prime

Blog Article

Pacific Prime Can Be Fun For Everyone

Table of ContentsThe smart Trick of Pacific Prime That Nobody is DiscussingThe Facts About Pacific Prime RevealedNot known Details About Pacific Prime Not known Details About Pacific Prime The Basic Principles Of Pacific Prime

Insurance policy is a contract, represented by a plan, in which an insurance holder gets financial protection or repayment versus losses from an insurance coverage company. The company swimming pools clients' threats to pay more budget friendly for the insured. The majority of individuals have some insurance: for their car, their residence, their healthcare, or their life.Insurance coverage likewise aids cover prices associated with obligation (lawful duty) for damages or injury created to a 3rd party. Insurance coverage is a contract (policy) in which an insurance firm indemnifies one more against losses from particular backups or hazards.

Investopedia/ Daniel Fishel Many insurance coverage kinds are readily available, and virtually any private or organization can locate an insurance provider prepared to insure themfor a cost. Typical personal insurance plan kinds are auto, health, house owners, and life insurance. Most people in the USA contend least one of these types of insurance, and car insurance policy is needed by state legislation.

10 Easy Facts About Pacific Prime Described

Locating the rate that is right for you needs some research. The plan restriction is the optimum amount an insurance company will certainly spend for a covered loss under a plan. Optimums might be set per period (e.g., yearly or plan term), per loss or injury, or over the life of the plan, additionally called the lifetime maximum.

Plans with high deductibles are typically more economical since the high out-of-pocket expenditure normally leads to fewer small cases. There are several sorts of insurance coverage. Allow's check out the most important. Medical insurance assists covers routine and emergency clinical care expenses, typically with the option to include vision and dental solutions individually.

Many preventive solutions might be covered for totally free prior to these are met. Wellness insurance policy may be purchased from an insurance policy firm, an insurance coverage representative, the federal Health Insurance coverage Market, supplied by a company, or government Medicare and Medicaid insurance coverage.

Indicators on Pacific Prime You Should Know

The firm after that pays all or most of the protected costs linked with an auto crash or other car damages. If you have a leased lorry or borrowed cash to purchase a vehicle, your lending institution or leasing dealership will likely require you to carry vehicle insurance coverage.

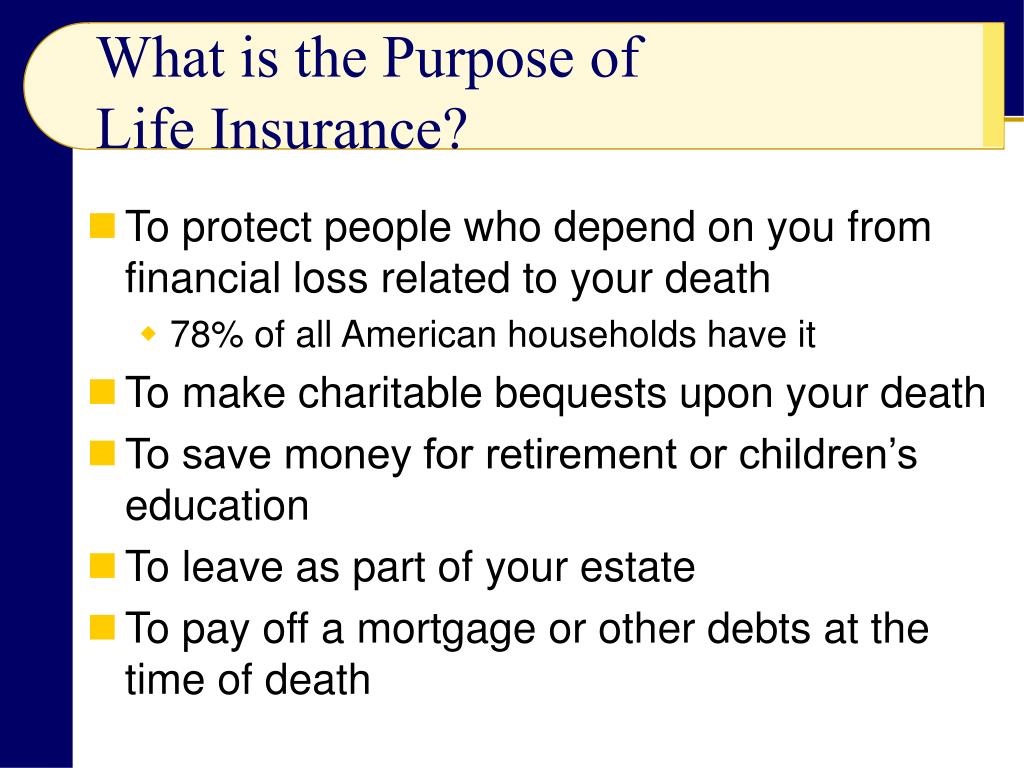

A life insurance plan assurances that the insurer pays an amount of money to your recipients (such as a spouse or kids) if you pass away. In exchange, you pay premiums during your life time. There are 2 primary types of life insurance policy. Term life insurance policy covers you for a details period, such as 10 to twenty years.

Insurance coverage is a method to handle your economic threats. When you acquire insurance, you purchase protection against unexpected financial losses.

The 3-Minute Rule for Pacific Prime

There are lots of insurance plan kinds, some of the most typical are life, health, homeowners, and auto. The appropriate sort of insurance coverage for you will depend on your objectives and economic circumstance.

Have you ever had a minute while checking out your insurance plan or looking for insurance when you've believed, "What is insurance? And do I really need it?" You're not the only one. Insurance coverage can be a mysterious and perplexing thing. Exactly how does insurance job? What are the advantages of insurance coverage? And just how do you discover the very best insurance coverage for you? These are usual concerns, and the good news is, there are some easy-to-understand answers for them.

No one desires something negative to happen to them. Suffering a loss without insurance policy can put you in a challenging economic scenario. Insurance coverage is a crucial economic tool. It can check out this site help you live life with fewer worries understanding you'll obtain financial aid after a disaster or accident, assisting you recoup much faster.

See This Report on Pacific Prime

And in many cases, like vehicle insurance policy and employees' payment, you may be required by law to have insurance policy in order to secure others - expat insurance. Discover ourInsurance choices Insurance is essentially a big wet day fund shared by lots of people (called insurance holders) and handled by an insurance service provider. The insurer makes use of money accumulated (called premium) from its insurance holders and various other investments to spend for its operations and to meet its guarantee to policyholders when they sue

Report this page